您现在的位置是:Fxscam News > Exchange Dealers

UK consumer confidence rose in June, but Middle East tensions and energy costs cloud the outlook

Fxscam News2025-07-22 08:11:13【Exchange Dealers】4人已围观

简介How does a foreign exchange company make money money,What is a foreign exchange trading company,UK June Consumer Confidence Reaches New High of the YearAccording to data released by market researc

UK June Consumer Confidence Reaches New High of the Year

According to data released by market research company GfK on How does a foreign exchange company make money moneyFriday, the UK consumer confidence index rose to -18 in June, an improvement from May's -20, reaching the highest level since 2025. This data reflects the increased optimism of the British public about the economic outlook, especially as inflation gradually eases and interest rate policies stabilize.

However, GfK pointed out that the current index still falls below the long-term average of -11 and has not returned to the normal range seen before the pandemic, indicating that the recovery in confidence remains fragile.

Middle East Tensions Raise Inflation Expectations

Despite the improvement in confidence, ongoing geopolitical conflicts in the Middle East cast a shadow over the UK's economic outlook. Since the end of May, Brent crude oil prices have risen by about 20%. UK consumers may face renewed pressure from rising fuel prices in the coming weeks.

The Bank of England also stated this Thursday that it is closely monitoring the potential impact of the situation between Israel and Iran on inflation. As energy is a significant component of inflation, any geopolitical risks could trigger a chain reaction, particularly in the UK, where energy prices are already high.

Uncertainty Remains in Consumer Spending Outlook

Neil Bellamy, GfK's Head of Consumer Insights, noted in a statement, "With the escalation of conflicts in the Middle East, gasoline prices will further increase, and uncertainties related to tariffs remain." He emphasized that these factors could suppress UK consumers' purchasing power in the short term.

The report also showed that although the outlook on the national economy has improved, the confidence index measuring personal financial situation remained unchanged in June. This means that while people are optimistic about the macroeconomy, they remain cautious about their financial abilities.

Caution

Market analysts pointed out that although British consumer sentiment has improved, it still faces challenges from energy price fluctuations, inflation uncertainty, and global geopolitical tensions. In the coming months, if oil prices continue to rise, it could again affect consumer spending, thereby dragging down the momentum of overall economic recovery.

In addition, how the Bank of England balances inflation and interest rate adjustments will also become a key factor in affecting the continued recovery of consumer confidence.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

很赞哦!(9)

相关文章

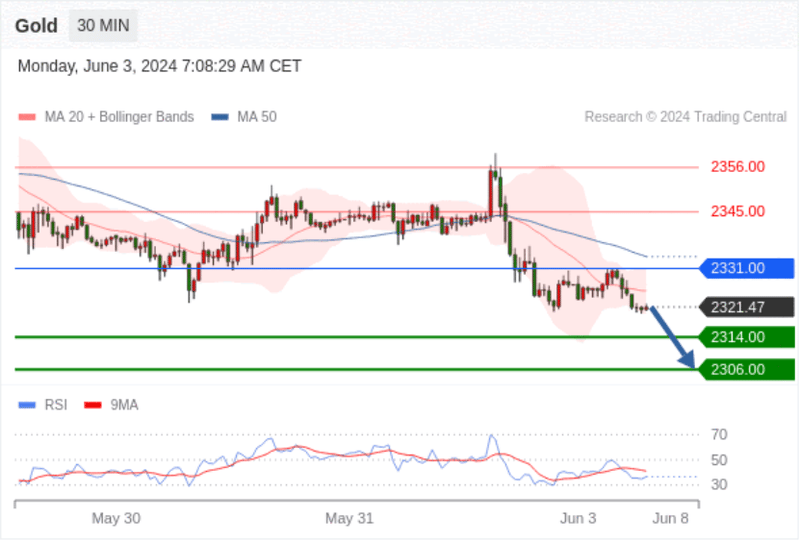

- Market Insights: Nov 30th, 2023

- Brazilian energy giant "targets" Bolivian lithium resources

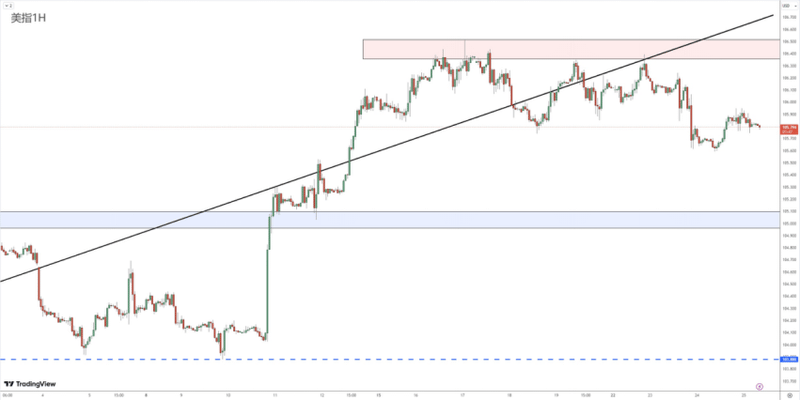

- The US Dollar Index plummeted by over 10% in half a year, falling below the 97 mark.

- The dollar fell to a three

- ASIC's latest investor alert list adds 77 suspicious websites

- Katsunobu Kato emphasizes the need for dialogue and reform to stabilize the government bond market.

- US Dollar Index logs worst 50

- Geopolitical risks in the Middle East are reshaping the safe

- FxPro Important Notice: Trading Hours Update During Catholic Easter Holiday

- BIS issues its most severe warning yet: Stablecoins are not "sound money".

热门文章

- IBM decided to sell the Weather Company's assets to Francisco Partners.

- Trump's pressure on the Fed weakened the dollar, while trade tensions caused the yuan to fall.

- Japan denies Besant's statements regarding the yen exchange rate.

- The Bank of Korea has lowered the interest rate to 2.75%, but the economic outlook remains grim.

站长推荐

11.23 Industry Updates: LMAX Obtains RMO License in Singapore

Euro surge sparks short squeeze as Goldman and Morgan Stanley turn bearish on the dollar

Trump's tariff policy raises concerns, the dollar weakens against various currencies.

Middle East conflict escalation pressures British pound, leading to its decline amid rising risk ave

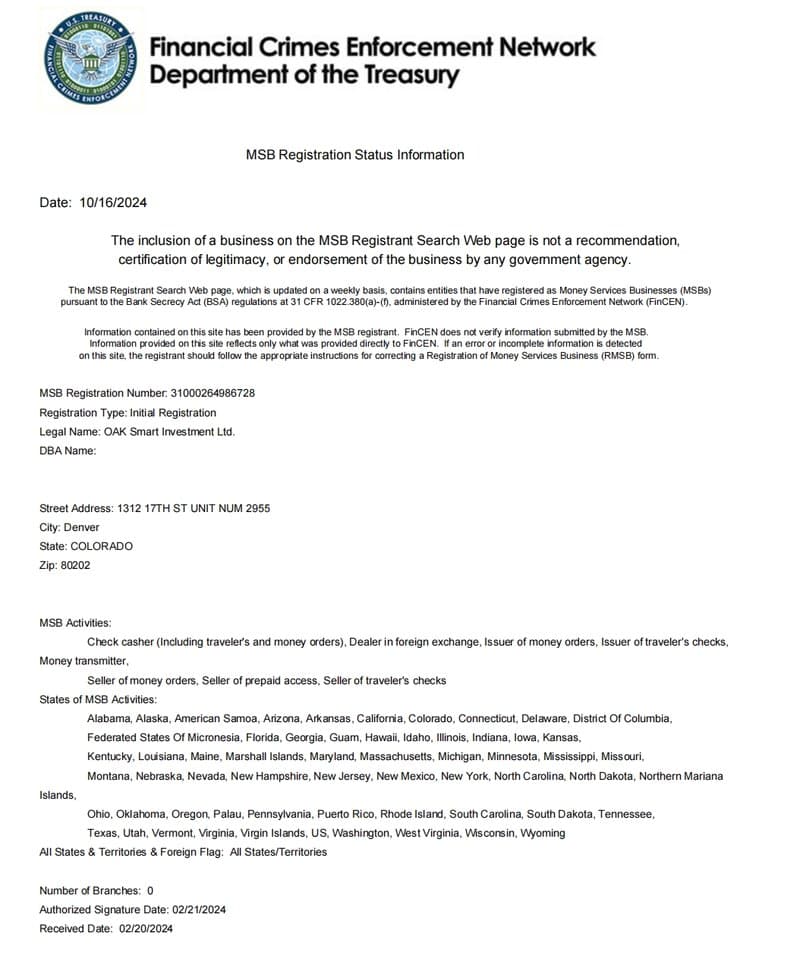

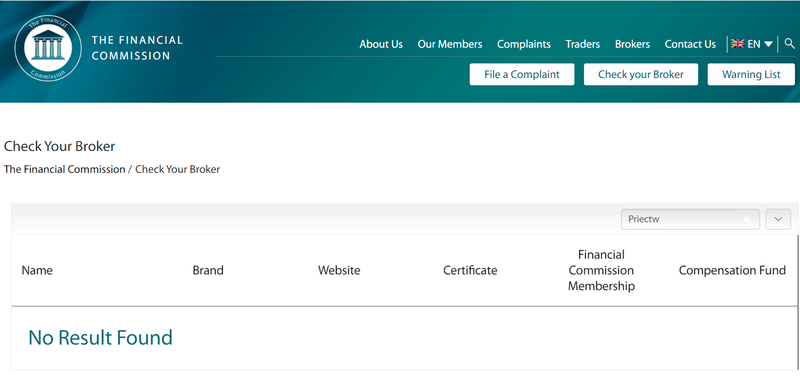

SSJTCF is taking your money! Watch out!

The Reserve Bank of Australia faces its first consecutive rate cuts in six years.

Lagarde: The Euro Could Become a Substitute for the Dollar

US Dollar Index logs worst 50